ACQUIRE THE SPECIFIC SKILLS IN PRIVATE EQUITY TO SUCCEED IN THE FINANCE INDUSTRY

AT A GLANCE

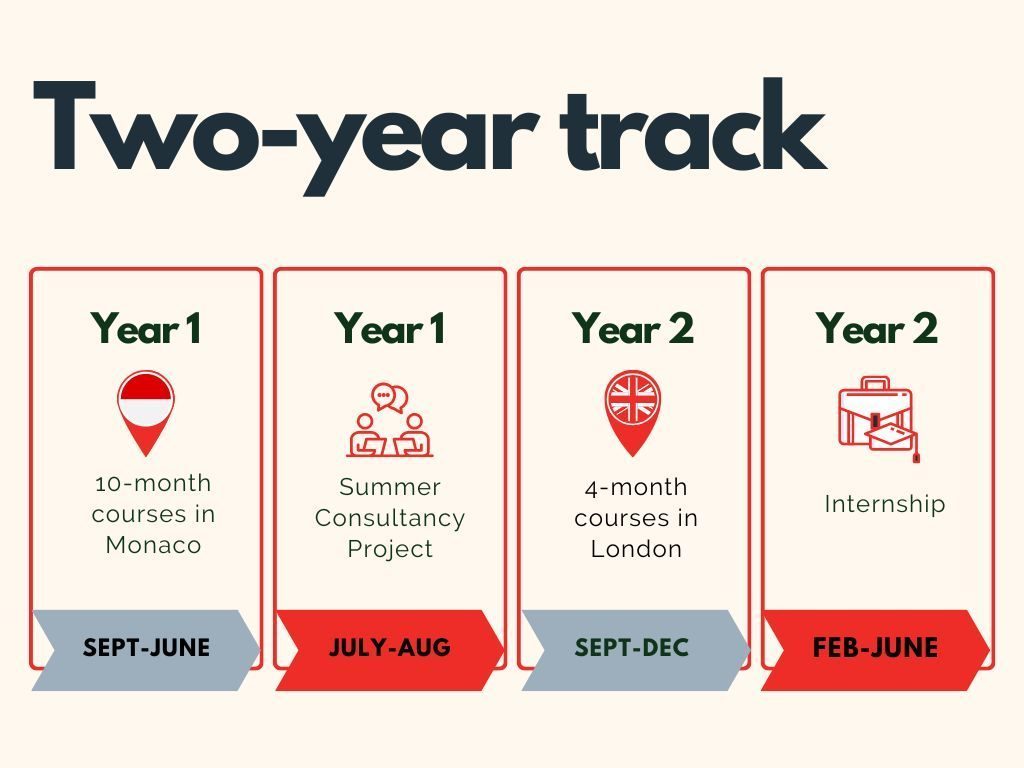

This two-year track aims to equip students with in-depth knowledge of the highly competitive Private Equity sector.

Students will have the opportunity to experience the Monaco financial center and, during the second year, discover some world’s leading private equity firms and the major financial institutions in London.

WHY THIS PROGRAM?

- Develop a deep understanding of how private equity funds are structured, operate, and govern their portfolio companies.

- Explore private equity as an asset class and advance your understanding of the latest research, strategies, and insights.

- Discover how to analyze assets, investigate selection and acquisition processes, and consider final disposal and capital realization.

- Review and debate real-world examples of the challenging decisions private equity experts have had to make.

Master the full spectrum of traditional, alternative and innovative investment strategies in Private Equity and Investment Banking

This Finance degree gives you a solid foundation in financial analysis with a strong emphasis on real life applications in order to sharpen your business sense.

The Master’s degree in Private Equity and Investement Banking thanks to small class sizes is able to ensure a high quality learning process.

This Finance program integrates IUM’s network of asset managers and alternative fund managers in the courses conception in order to insure that the curriculum includes the latest developments and expectations of the alternative finance industry. You can tailor your learning in order to suit to your ultimate career objectives.

IDEAL APPLICANT

Young graduate students with a BA or BSc Major in Economics, Business, Finance, or graduate students with an Engineering diploma who own:

- A genuine interest in business, financial analysis, company valuation with a 360° perspective, corporate finance advisory, and planning;

- A former experience (e.g., internships, applied projects, etc.) in “company valuation,” corporate finance, audit, business consulting, and equity analysis.

- A willingness to pursue a career in “Private Markets” investments or debt: venture capital investments, private equity investments, private debt structuring, M&A or IPO deals, and business angels.

This MSc in Finance track is also suitable for young professionals (with ideally 1 to 3 years of work experience) within the audit, financial advisory, or financial institution industry who are willing to re-focus their career path on private equity markets and direct investments.

Private Equity & Investment Banking specialization

STUDY PLAN

YEAR 1

| FALL SEMESTER (September-December) | LOCATION MONACO | US CREDITS |

| Transversal Skills | Time Management and Collaborative Work | 2 |

| Report Writing and Referencing | ||

| Presentation Skills | ||

| Core Module 1: Pillars of Corporate Finance | Financial Accounting for Investments | 9 |

| Corporate Finance | ||

| Stock Valuation | ||

| Applied Business Project – Corporate Valuation | ||

| Core Module 2: Pillar of Market Finance | Macroeconomics for Financial Forecasting | 6 |

| Statistics and Financial Data Analysis | ||

| Bond Valuation |

| SPRING SEMESTER (Janaury-June) | LOCATION MONACO | US CREDITS |

| Core Module 3: The Financial Industry | Investment Banking | 4 |

| Ethics in the Financial Industry | ||

| Foreign Exchange Investing | ||

| Core Module 4: Advanced Financial Markets | Risk Management | 8 |

| Derivative Products and Strategies | ||

| Portfolio Theory and Management | ||

| Applied Business Project – Corporate Valuation | ||

| Specialization Module 1: Private Equity & Investment Banking 1 | Buyout Investing | 7 |

| Real Estate Investing | ||

| M&A |

YEAR 2

| FALL SEMESTER (September-December) | LOCATION LONDON | US CREDITS |

| Specialization Module 2: Private Equity & Investment Banking 2 | 12 | |

| Applied Business Project: Consultancy Project | ||

| Management Consulting | ||

| Investment Banking & IPO | ||

| Venture Capital & Early Stage Financing | ||

| Private Debt Markets | ||

| Deal Structuring | ||

| Corporate Restructuring |

| SPRING SEMESTER (January-June) | US CREDITS | |

| Core Module 5: Capstone project | ONE option among: | 12 |

| Professional Internship | ||

| Research Thesis | ||

| Applied Research Project | ||

| Entrepreneurial Project | ||

| TOTAL US CREDITS | 60 |

Admissions and Fees of the Master of Science in Finance

We strive to select a diverse student body, that reflects a variety of backgrounds, cultures, and nationalities but a wide range of personal interests and professional ambitions. We seek applicants with high potential worldwide who wish to share their talent and dreams with their community.

Admission Criteria

- A 3 or 4-year university degree

- Proof of English proficiency

Upload the required documents

- Letter of motivation

- University degrees and official transcripts

- CV

- Passport or ID card photocopy

- ID picture

- Proof of English proficiency (TOEFL, IELTS, Cambridge)

- 80€ application fees

- Letter of recommendation is not mandatory

Interview

- Face to face

- Phone interview

- Video call interview

The Admission jury meets once per month.

Fees

For the Private Equity and Investment Banking Specialization, the 24-month program tuition is: €31,250.

Contact-us

For further information

Call us:

+377 97 986 996

Send us an email:

admissions@monaco.edu

CAREER OPPORTUNITIES

Career prospects in investment banks, strategic consulting companies, and various investment management companies (venture capital, private equity, impact investment, real estate investment funds, private debt structuring, M&A and/or IPO planning, etc.) and large family offices.